Our advanced digital banking platform can transform the way you bank — adding convenience while providing you with additional insight and control over your money. To ensure you get the most out of all your digital banking has to offer, we are spotlighting our favorite tools that you won’t want to miss.

Digital Banking Spotlight

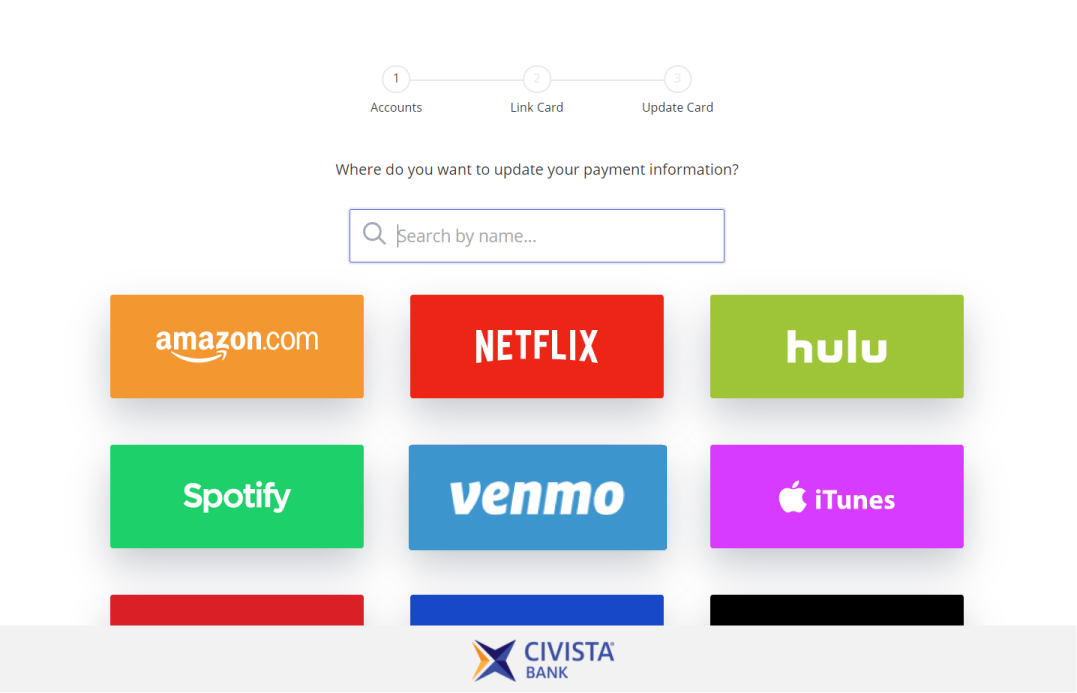

1. Civista CardSwap

By using CardSwap you can update your payment information for all of your favorite online accounts — like Netflix, Amazon, Venmo and many more1. Save time and effort managing your preferred payments to your streaming and subscription services, as well as many other online retailers from a single login, at the same time.

Learn more about CardSwap with our deep-dive overview of this advanced tool.

2. Recurring Transfers

This basic feature can save you tons of time by automating the transactions you do on a regular basis. Your digital banking allows you to set up recurring transfers for your Civista accounts, other Civista customer accounts and your accounts at other financial institutions.

Civista Users Tool

Send money to your spouse, children or friends easily with the Civista Users tool. Choose one-time transfer or link accounts that you regular send money to and even schedule future-dated and recurring transfers. Note – the Civista Users tool only allows you to send money to linked users. You will not be able to transfer money from a linked Civista User’s account or view their account balances.

3. Bill Pay

Bill Pay is a valuable tool for managing your payments – for bills, as well as, family and friends. Save a stamp and time each month by setting up recurring payments for your monthly bills.

Easily manage your payees and payments from your digital banking portal. You can also set up personal payees to receive money anywhere in the U.S. with just an email address and our Pay a Person (P2P) option.

4. Mobile Deposit

With direct deposit, popular payment apps and digital wallet options, you may not receive many paper checks anymore. However, when you do, mobile deposit allows you to easily and conveniently deposit your check from anywhere, anytime – even if your local branch is closed2. Instead of making a trip to the bank, deposit checks directly to your account from your mobile device. It’s as easy as taking a picture.

5. Personal Financial Management (PFM) Tool

Within your digital banking portal, you will have access to Civista’s Financial Tools for Personal Financial Management. This tool lets you manage your money and other assets all from a single login for a better understanding of your finances. Even link accounts at other financial institutions for a complete financial picture.

Learn more about Civista’s Personal Financial Management tool in our in-depth overview.

6. Card Management Tool

Civista’s card management tool gives you peace of mind. If you lose or think you’ve lost your debit card, this feature allows you to suspend your card and then reactivate it once it’s found.

Utilizing this tool when you’re not using your card is a great option for an added layer of security.

7. Account Alerts

Account alerts are underrated tools for managing your banking. With Civista’s digital banking alerts you’re able to set customized balance alerts to notify you when your account dips below a certain amount – which can save you overdraft fees.

You can also set alerts to notify you when different types of transactions post to your account or when a specific check number clears — even set a reminder to prepare for upcoming expenses.

Bonus Tip: Customize Your Account Dashboard

Your digital banking gives you the ability to customize your home dashboard for a more productive and personalized view. Your main dashboard is made up of tiles that show the name of your account and relevant details.

Organizing and Grouping Accounts

Your tiles can be dragged and dropped to arrange them however you like. You can even create groups to better visualize all of your accounts. For example, if you have multiple checking accounts you can group them so they appear together in the same section.

Nickname Accounts

Another great way to personalize your digital banking is to nickname your accounts. Rename your savings account ‘Emergency Savings’ or ‘Vacation Fund’ to easily recognize and manage your money. Note – these nicknames are unique to your personalized dashboard. Joint owners and your Civista Banker will not be able to see what you named your accounts.

Hide Accounts

You can hide accounts from your home dashboard view to declutter and simplify your view. If you’re joint owner on multiple accounts or want to eliminate the temptation of tapping into your rainy day fund you can hide these accounts from your dashboard.

Digital banking doesn’t have to be complicated, in fact our easy to use tools can help you simplify your everyday banking and spend less time worrying about your finances. We encourage you to take advantage of all the tools and features your digital banking has to offer and remember to bank smarter not harder with Civista digital banking.

- The listed companies are not sponsors nor endorsers of this product.

- Cut of time for deposit is 5:00 p.m. EST. Deposit images received by the Bank after 5:00 p.m. EST will be processed on the next business day.

Skip Navigation

Skip Navigation