Imagine waking up to find your hard-earned money gone or discovering that a loved one has fallen victim to a scam. It’s a sinking feeling—one that too many people experience. Financial fraud is no longer a distant threat; it’s happening every day, affecting people from all walks of life. The fear of being scammed, or seeing a family member tricked, is very real. That’s why protecting yourself and those you care about has never been more important.

At Civista Bank, we understand the frustration, anger, and anxiety that comes with financial fraud. But there’s good news: by arming yourself with knowledge, you can build a shield against these threats. Let’s explore some of the most common scams, ways to spot them, and steps you can take to keep your finances—and your loved ones—safe.

Key Takeaways:

- Impersonation scams, check washing, and check theft are some of the most common fraud threats.

- Scammers often use urgency and pressure tactics to trick victims into sharing personal information or making quick payments.

- Avoid clicking on suspicious links, and always verify unexpected requests by contacting the organization directly.

- Limiting your use of paper checks, securely storing them, and monitoring your mail can significantly reduce the risk of check fraud.

- Regularly monitor your credit reports, set up fraud alerts, and freeze your credit to protect against identity theft.

- Share what you’ve learned about fraud prevention with your family and help them take proactive steps to safeguard their finances.

Who Is at Risk?

There’s a common misconception that fraud victims are mostly those who aren’t tech-savvy or are easily fooled. However, scammers target everyone, regardless of their knowledge or experience. In fact, according to the Federal Trade Commission (FTC), young adults (ages 20-29), often seen as tech-savvy, report being scammed more frequently than any other age group—though older adults typically suffer greater financial losses when they are victimized.

This highlights that fraud isn’t about your level of tech knowledge or wealth—it’s about vulnerability. That’s why everyone, no matter their situation, needs to take steps to protect themselves.

Common Scams to Stay Vigilant Against

Impersonation Scams

Impersonation scams occur when fraudsters pose as someone you trust—such as a bank, government agency, or even a family member. Their goal is to trick you into sending money or providing sensitive information. As scammers become more sophisticated, these scams are becoming harder to detect.

How to Spot an Impersonation Scam

Scammers often use clever tactics to mimic trusted institutions or people. Here are some key warning signs that you might be dealing with an impersonation scam:

- Unexpected Contact: If you receive an unsolicited call, email, or text from a supposed trusted source asking for personal or financial information, be cautious.

- Spoofed Information: Scammers often use technology to spoof legitimate phone numbers or emails, making them appear credible.

- Urgency and Pressure: They’ll create a sense of urgency, saying immediate action is needed to avoid penalties or missed opportunities.

- Unusual Requests: Legitimate organizations, including Civista, will never ask for sensitive information like your Social Security number or login credentials via unsolicited messages.

- Too Good to Be True: Offers that seem too good to be true, like winning a prize or lottery you never entered, should raise red flags.

Examples of Impersonation Scams

- Fake Bank Calls or Emails: You receive a call or email from someone claiming to be your bank, asking you to verify your account details or make an urgent payment to resolve a "problem" with your account.

- Government Impersonation: Fraudsters may pretend to be from agencies like the IRS or Social Security Administration, threatening fines or legal action if you don’t provide personal information or payment.

- Delivery Service Scams: A scammer pretends to be from a delivery service, claiming there’s a problem with a package you weren’t expecting. They’ll request personal information or payment to "resolve the issue."

- Family Emergency Scams: A fraudster impersonates a family member in distress, claiming they need money wired immediately for a medical emergency, legal trouble, or other urgent situation. With the emergence of accessible AI technology, scammers can now mimic voices and personal details, making these impersonations even more convincing. For more information on how AI is being used in scams and how to protect yourself, read our article Navigating AI Scams.

- Tech Support Scams: You may receive a call or message from someone claiming to be tech support from a major company like Microsoft or Apple, stating that your device has a virus or issue and urging you to provide remote access or payment to "fix" it.

How to Protect Yourself from Impersonation Scams

Taking proactive measures can help you avoid falling victim to impersonation scams. Here are some ways to protect yourself:

- Verify suspicious contacts by reaching out to the organization directly using known contact information.

- Ignore unsolicited requests for sensitive information.

- Never rely on caller ID alone—scammers can spoof phone numbers.

- Implement multi-factor authentication (MFA) on your accounts for an added layer of security.

- Stay informed about the latest scam tactics.

Check Fraud

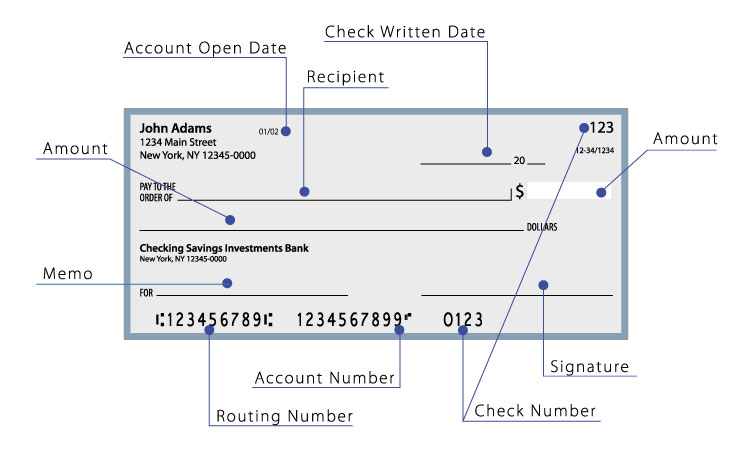

Check fraud is a growing threat that can lead to significant financial losses. With each check containing valuable information—such as your bank account number, routing number, and personal details—fraudsters have numerous ways to exploit this payment method.

Types of Check Fraud

- Check Washing: Thieves steal checks and use chemicals to erase the ink. They then rewrite the check with new information to steal larger amounts of money.

- Check Cooking: Scammers digitally alter a scanned check and print counterfeit versions, which they then use to drain your account.

- Check Theft: Fraudsters steal checks from your mail, home, or office and either cash them as-is or forge your signature.

- Forgery: After stealing checks, criminals alter details like the payee, amount, or your signature to commit fraud.

How to Protect Yourself

- Limit your use of paper checks and opt for digital payment methods whenever possible, like Civista’s Bill Pay and Pay-a-Person.

- When writing checks, use indelible black ink to make it harder for fraudster to alter them. Permanent gel pens like Uni-Ball are recommended by the Better Business Bureau.

- Avoid leaving blank spaces on checks — fill out every line completely. Draw a line through any remaining spaces on the payee and amount lines to avoid altering.

- Never include personal information like your Social Security or driver’s license number on a check.

- Securely store your checkbook and avoid leaving it unattended.

- Monitor your mail and sign up for USPS Informed Delivery to track incoming checks.

- Avoiding mailing checks if possible. If you must mail a check, take it directly to the post office rather than leaving it in your mailbox or a USPS blue box, which are frequently targeted by thieves.

- Regularly check your bank statements and paid checks to ensure amounts are accurate.

Additional Proactive Prevention Strategies

Protecting Your Credit

Your credit score plays a vital role in your financial health and protecting it should be a priority. Here are a few simple ways to safeguard your credit:

- Monitor Your Credit Reports: You are entitled to a free credit report from each of the major credit bureaus (TransUnion, Equifax, and Experian) once a year. By regularly reviewing these reports, you can catch signs of identity theft early.

- Set Up Fraud Alerts: Fraud alerts notify lenders to take extra steps in verifying your identity before opening new accounts. This adds an extra layer of protection against identity theft. These can be set up with each of the credit bureaus.

- Freeze Your Credit: A credit freeze prevents criminals from opening accounts in your name. It’s free and easy to set up with the major credit bureaus, and you can lift the freeze when needed.

For more information, check out Civista's quick guide to freezing your credit.

Protecting Your Loved Ones

In addition to protecting yourself, you play a key role in safeguarding your loved ones from fraud—especially elderly family members or children who may be more vulnerable. Here are some ways you can help:

- Educate Your Family: Share what you know about fraud prevention with your loved ones. Raising awareness about these scams can make a big difference.

- Help Them Monitor Their Credit: Assist your family members in setting up credit monitoring and fraud alerts.

- Secure Important Documents: Store checks and sensitive documents like Social Security cards, birth certificates, and financial information in a secure, fireproof lockbox. For digital records, ensure devices are password-protected and encrypted. For help in organizing your important documents check out Civista’s Documents Checklist.

Stay Vigilant, Stay Safe

At Civista, we are committed to helping you protect your finances and personal information.

"Effective fraud prevention is a two-way partnership," says KC Ernst, Civista Bank's Fraud Manager. "We have great tools that help us identify unusual activity, but it takes due diligence and awareness on the part of the customer as well. Together, we can be a great team to keep you safe."

By staying informed and taking proactive steps—like monitoring your accounts regularly, setting up fraud alerts, and protecting your personal information—you can significantly reduce your risk of falling victim to financial scams. If you ever have questions or suspect fraudulent activity on your account, don’t hesitate to reach out to us. We’re here to help.

Skip Navigation

Skip Navigation

.jpeg)