Control at Your Fingertips, Confidence in Your Pocket

Want the peace of mind of knowing when and how your debit card is used? What about more control to limit the amount you’re spending with your card - even the ability to turn your card on and off? It’s yours.

The Civista Debit Card Controls & Alerts service enables you to add more protection for your card right from your Civista Digital Banking.

Card Controls

Card controls allow you to set spending limits for specific transaction types and retailers. Ensure purchases outside of your preferences are declined.

Card Alerts

Be alerted via SMS text alerts and/or email notifications when your debit card is used. Customize your alert preferences such as online transactions, ATM withdrawals, and more.

Get Started

Easily enroll in this free service today.

- Log into your Civista Digital Banking.

- Select the 'Manage Cards' dropdown in your main menu.

- Select 'Debit Card Services & Controls'. Be sure your debit card is enabled.

- Select your card image (mobile) or 'Card Management' button (desktop).

- Select either 'Card Controls' or 'Card Alerts' to enroll.

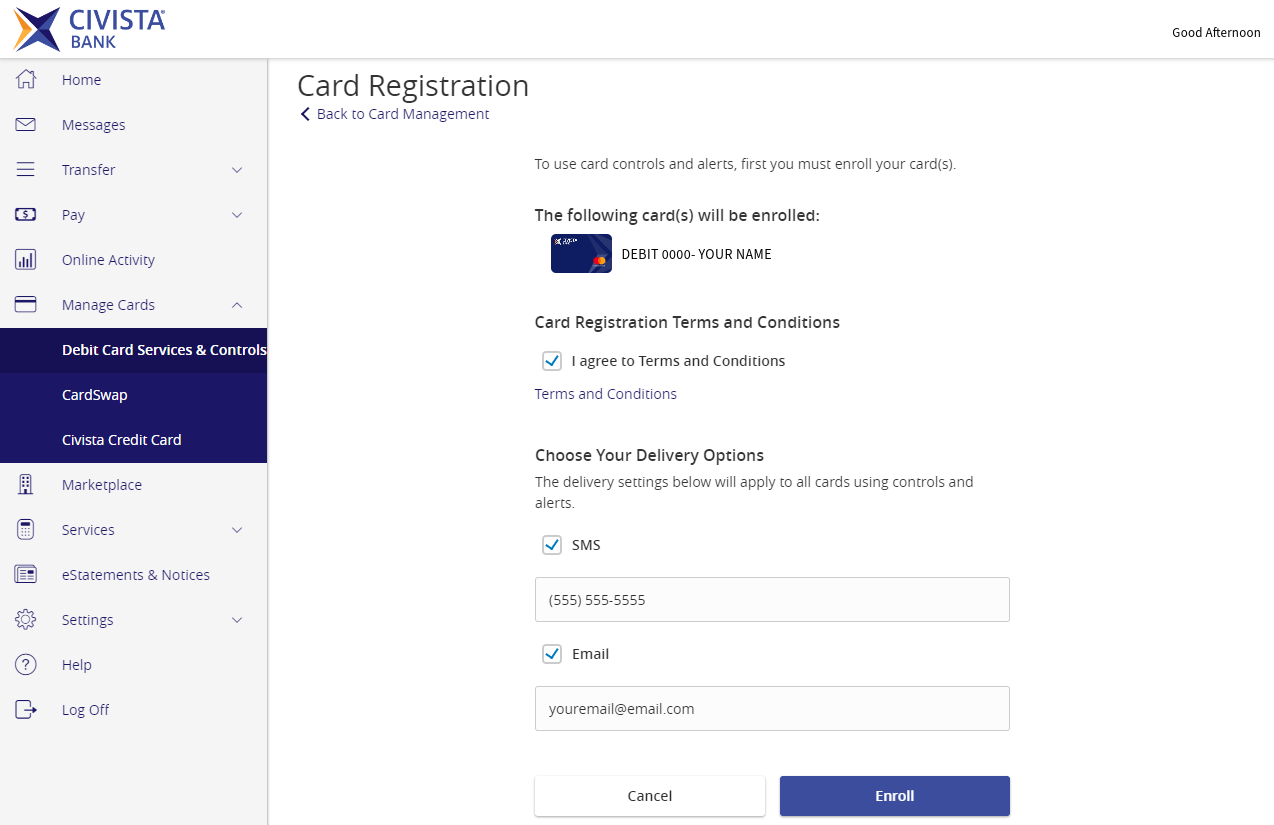

The 'Card Registration' screen will allow you to review and accept the Terms and Conditions and set up your SMS and/or email delivery preferences. Select 'Enroll' to complete the enrollment process and be redirected back to either the 'Card Controls' or 'Card Alerts' page.

By default, no card controls or restrictions are enabled, and you will be alerted for all debit card transactions.

Customize Your CARD CONTROLS

On the 'Card Controls' page, you can enable spending limits per transaction, spending limits per month, transaction-type, and retailer/merchant-type restrictions.

Once you have chosen your limits and/or restrictions, confirm your delivery preferences and select 'Submit Controls'.

Customize Your CARD ALERTS

On the 'Card Alerts' page, you can enable amount-based, transaction-type, and retailer/merchant-type alerts.

Once you have chosen your alert amounts and/or types, confirm your delivery preferences and select 'Submit Alerts'.

More Card Management Features

TEMPORARILY DISABLE/Enable CARD

Disable a lost card or turn your card on and off instantly as you use it for added security. This will not stop recurring transactions you may have set up – like monthly phone or streaming services.

ORDER REPLACEMENT

If your card is damaged, you can order a replacement card. Please notify Civista if your address has changed to avoid delays in receiving your card.

REPORT A CARD LOST, STOLEN OR FRAUD

Report a card as lost, stolen or having fraudulent activity wherever you are by logging into your digital banking. Be sure to check the ‘Order replacement’ box to receive a new card with a new card number. Please notify Civista if your address has changed to avoid delays in receiving your card.

TRAVEL NOTIFICATIONS

Avoid card service disruptions by letting us know when and where you will be traveling. Please allow 4 business hours for your travel to be notated.

Request Temporary Point-of-sale (POS) LIMIT Increases

Standard limits are:

- For personal cards, $500 at the ATM and $3,500 for purchases.

- For business cards, $500 at the ATM and $7,500 for purchases.

Within your digital banking, you can request a temporary increase for your Point of Sale (POS) daily limit. Temporary increases are good for up to 3 days. For extended temporary limits or larger limit amounts, please send a secure message. If you would like to request a permanent increase, please contact your branch or Civista Banker.

Temporary POS limit increases are dependent upon account balances and activity. Please allow 4 business hours for your request to be reviewed. A digital banking team member will send you a secure message to confirm your request.

REQUEST A NEW CARD

You can request a card for an account that doesn’t already have a debit card issued.

Frequently Asked Questions

Please note that this list is not exhaustive and does not include every specialized scenario.

Skip Navigation

Skip Navigation